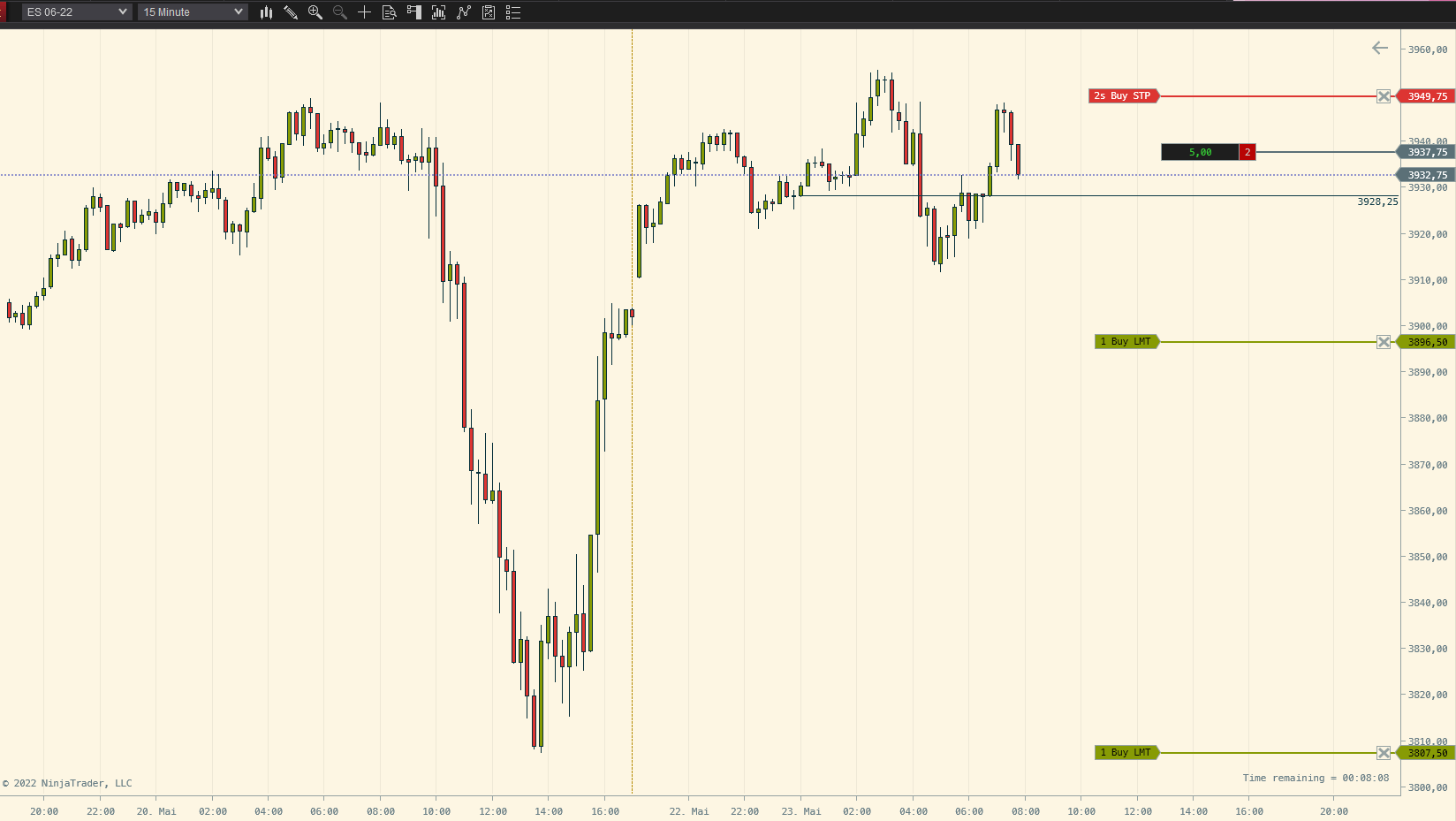

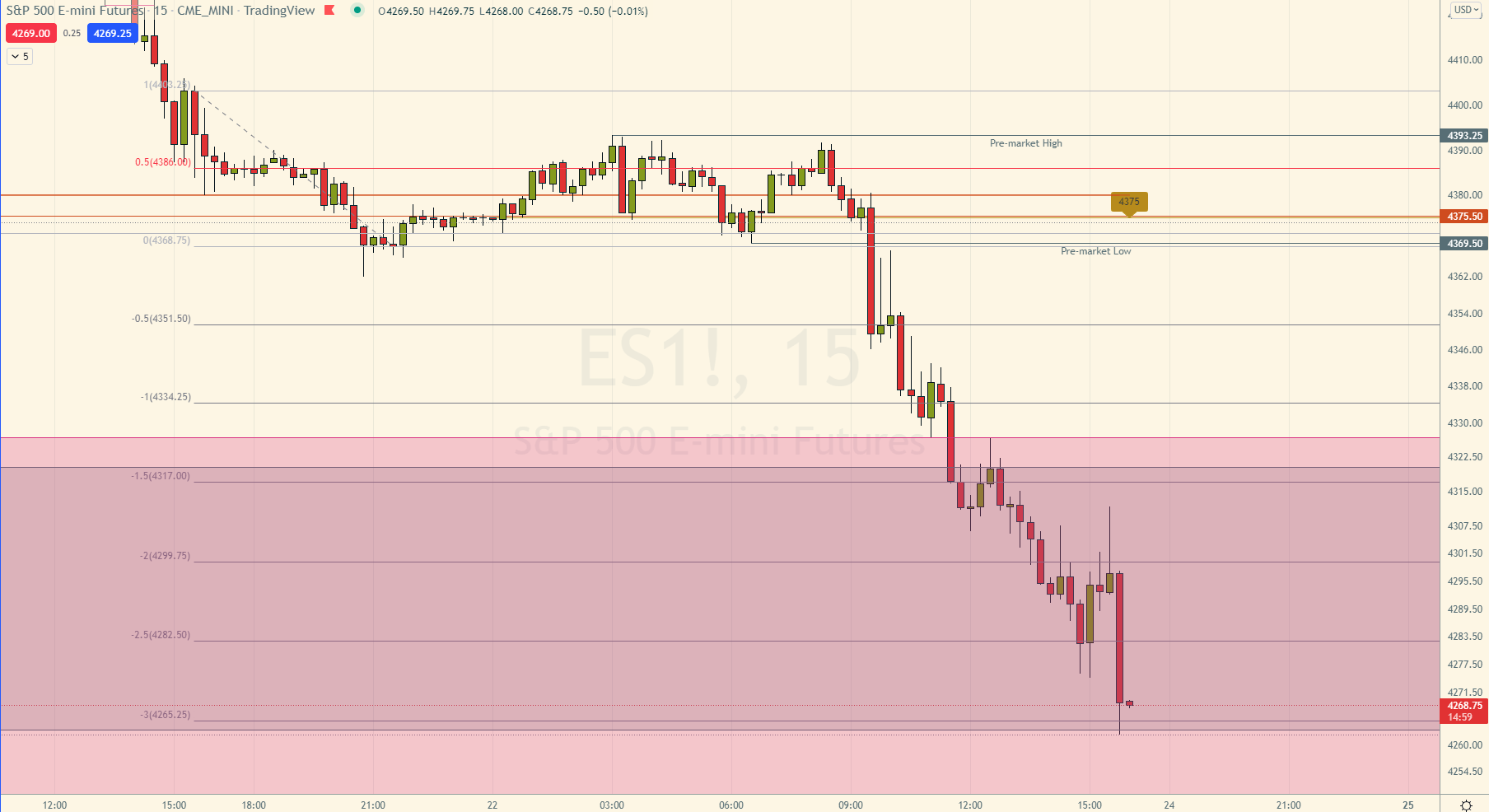

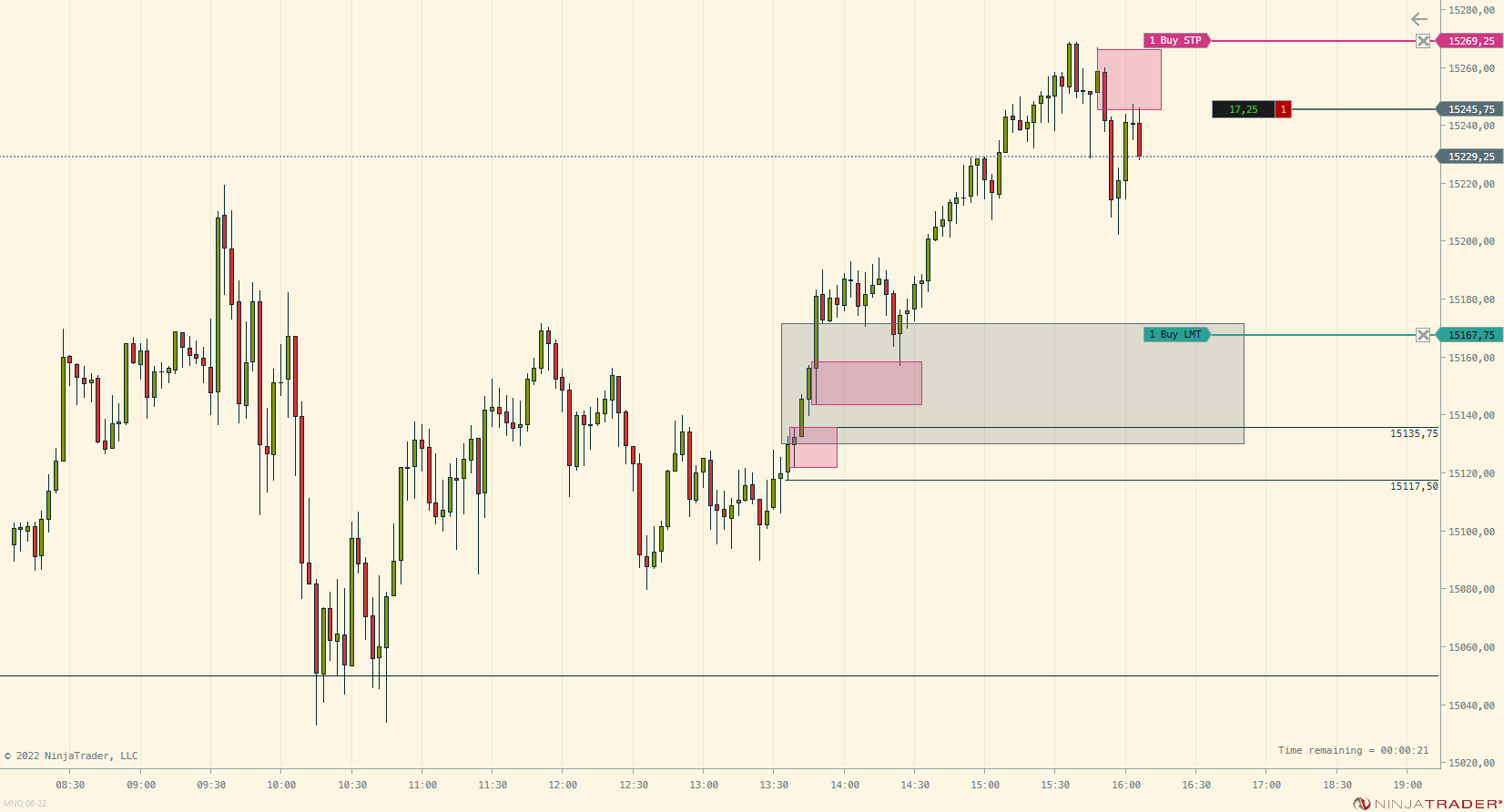

Papertrading $ES_F 15min, lets see how this plays out later on. #ICT

ICT

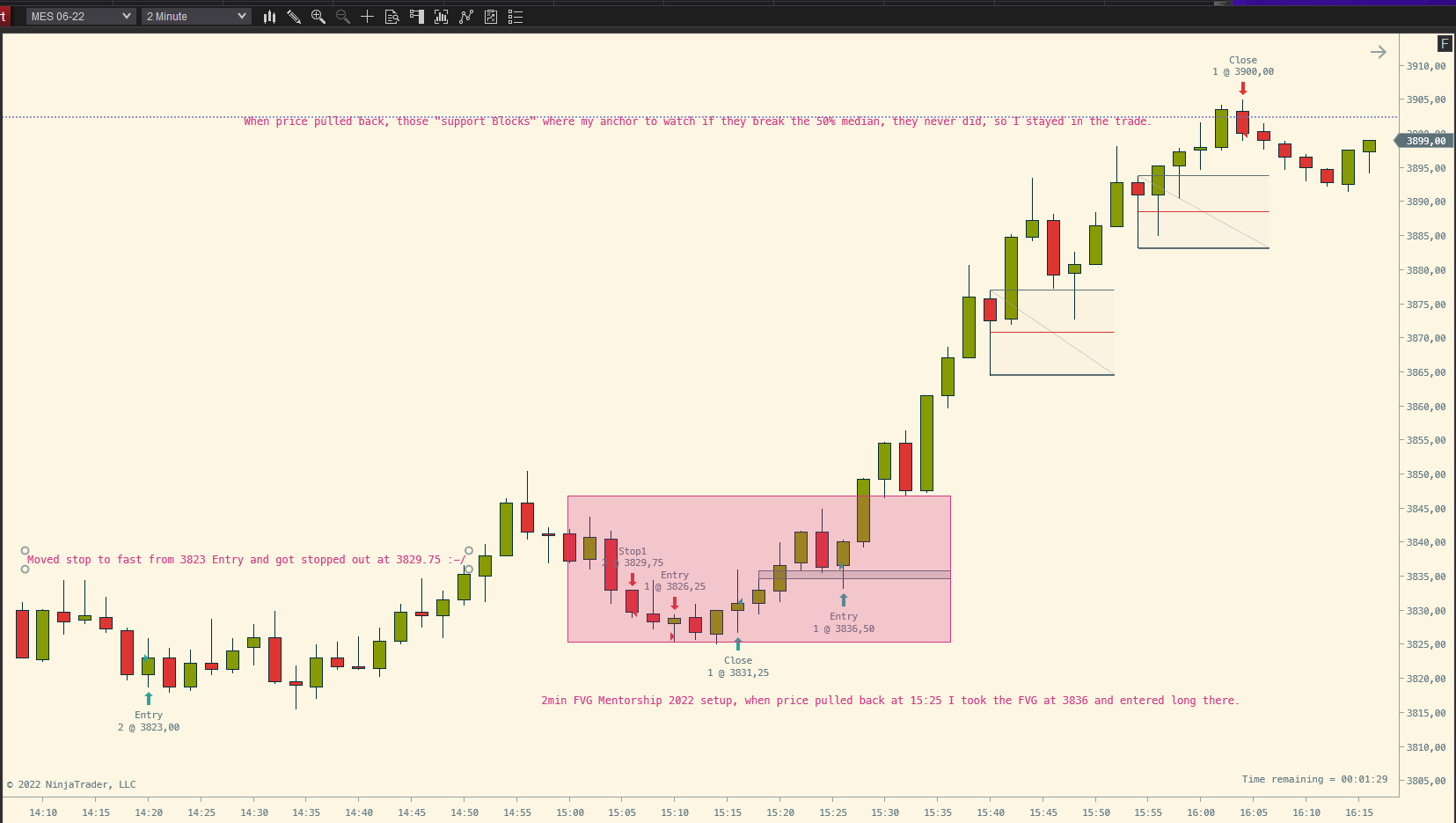

$MES 2min trade of the day for me - #ICT Mentorship 2022

- Entry today, finally the one 🙂 3836.50->3900.00 (1:12.7 R/R) 63handles.

ICTs teaching of “support OBs” gave me confidence to stay in the trade. Have marked with a 50% fib.

“Hold into close” 😅

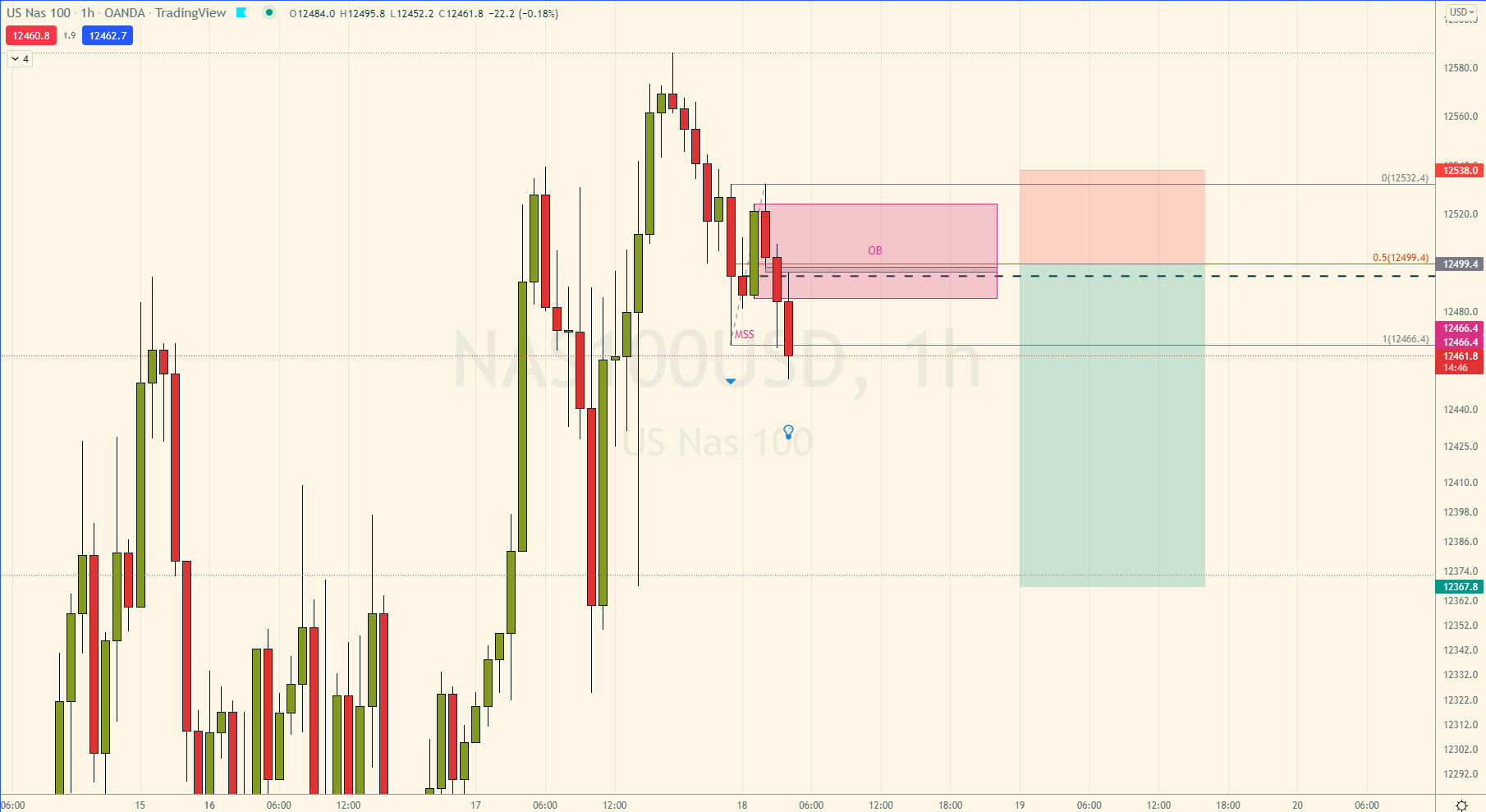

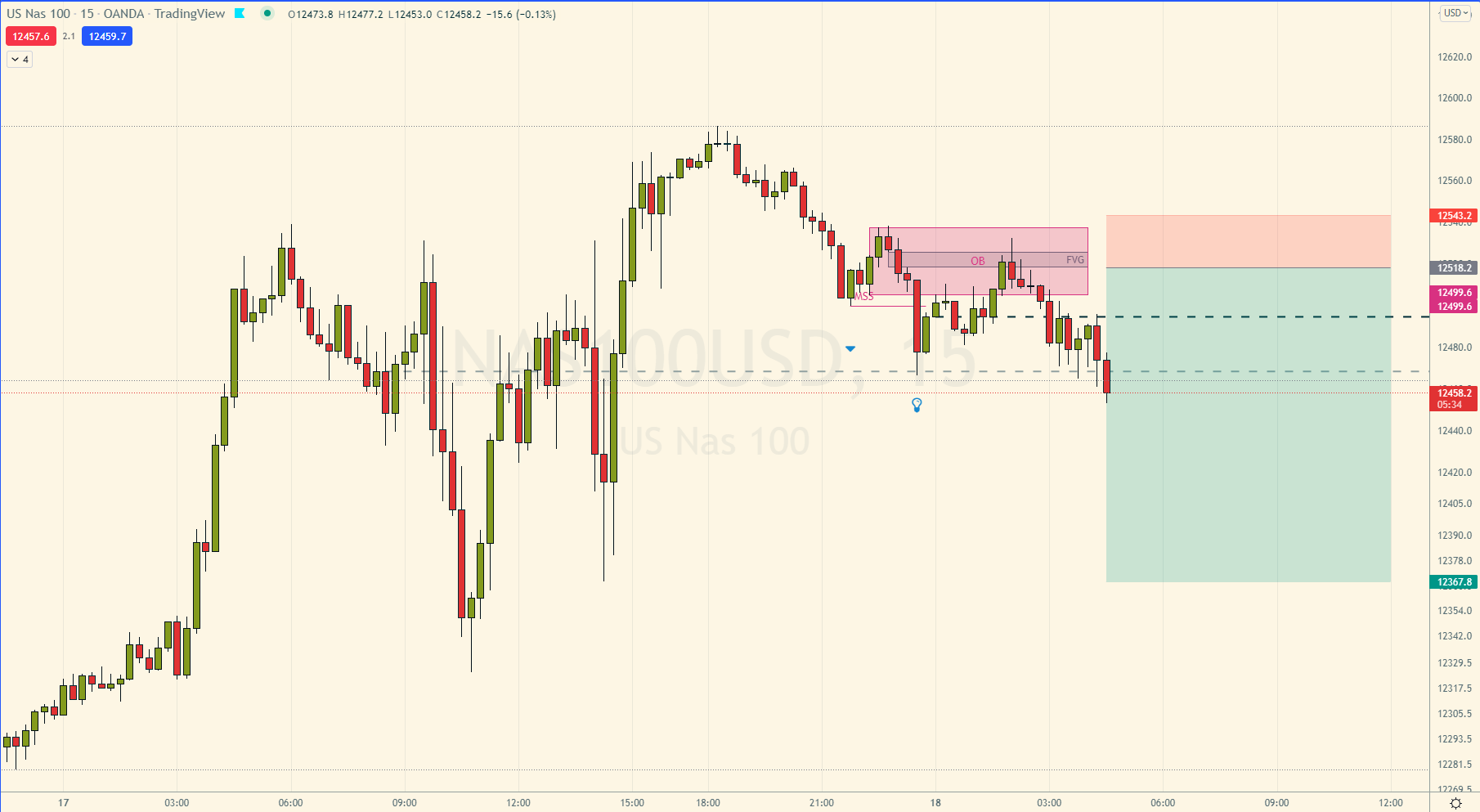

$NAS100 15min and 60min setup, not sure how this will work out, so no trade, just watch and learn #ICT

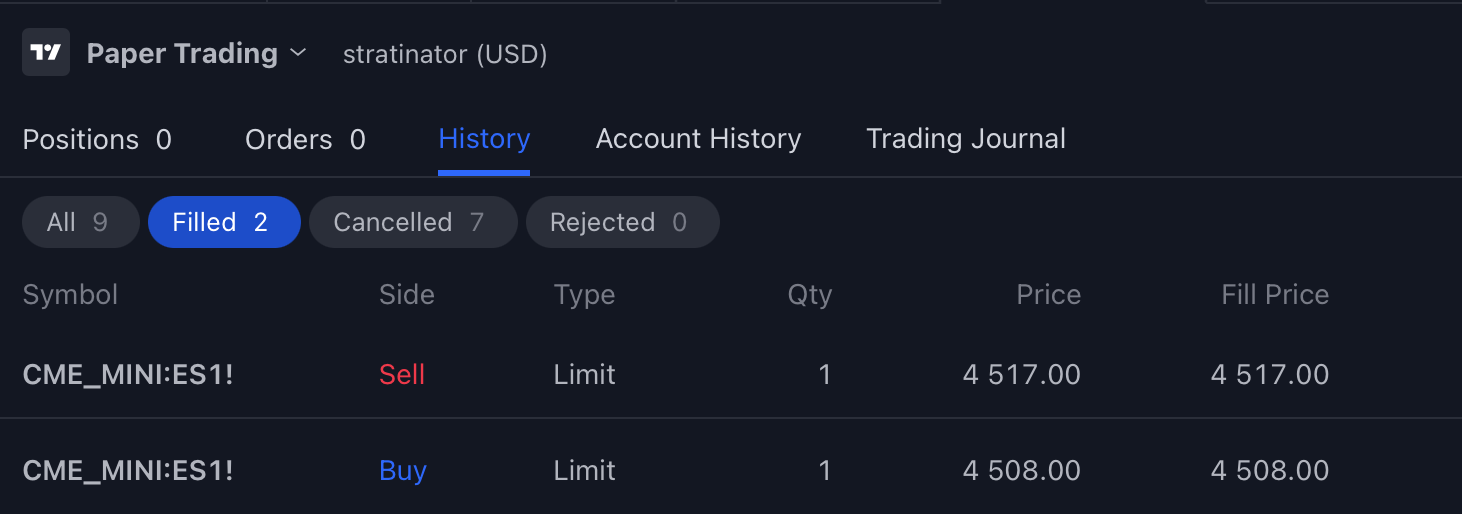

Instead of backtesting, I papertraded $BTCUSD with #ICT concepts (FVG/OB).

Got stopped out on both trades. Stops way above the FVG entry candles.

Target was #TheStrat 12hr 2d-1-2d (38205.01), which worked a few mins later 🤷♂️

Is Crypto that different?

Played around with some video editing today.

Result is this #ICT $NQ_F Long

Seems like I accidentally took the only long possibility today :-)

Enjoy and have a great weekend!

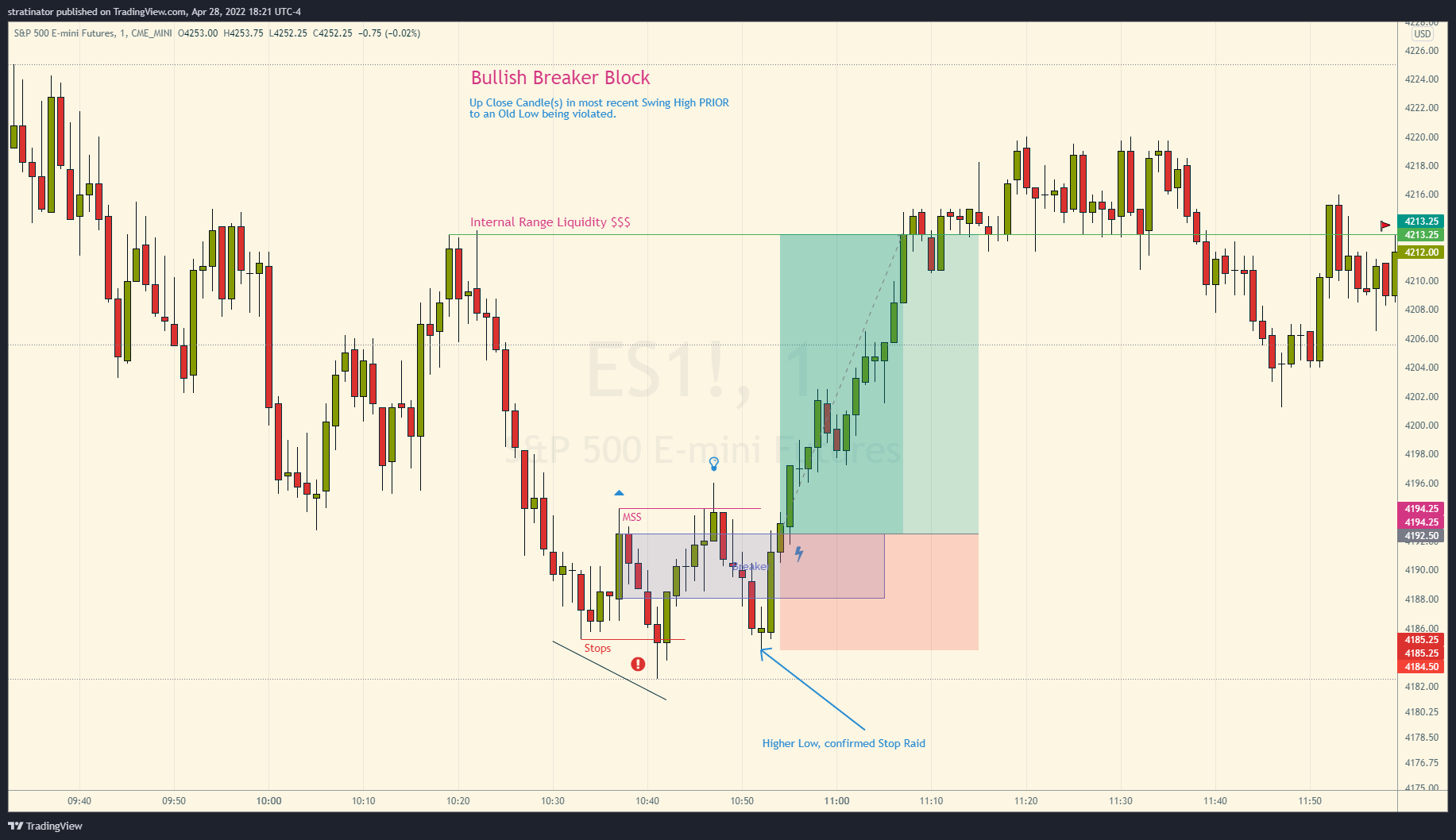

Hindsight $ES_F 1min chart annotating #ICT.

Was not on the trading desk the whole day, except last hour. Backtesting some #ICT concepts and see if I had spotted the move up before it happened.

Stops are pretty wide in current conditions, so 8 handles $ES_F is a huge stop.

It’s currently really quiet on my public timeline, since I take the market hours to watch and learn #ICT strategies.

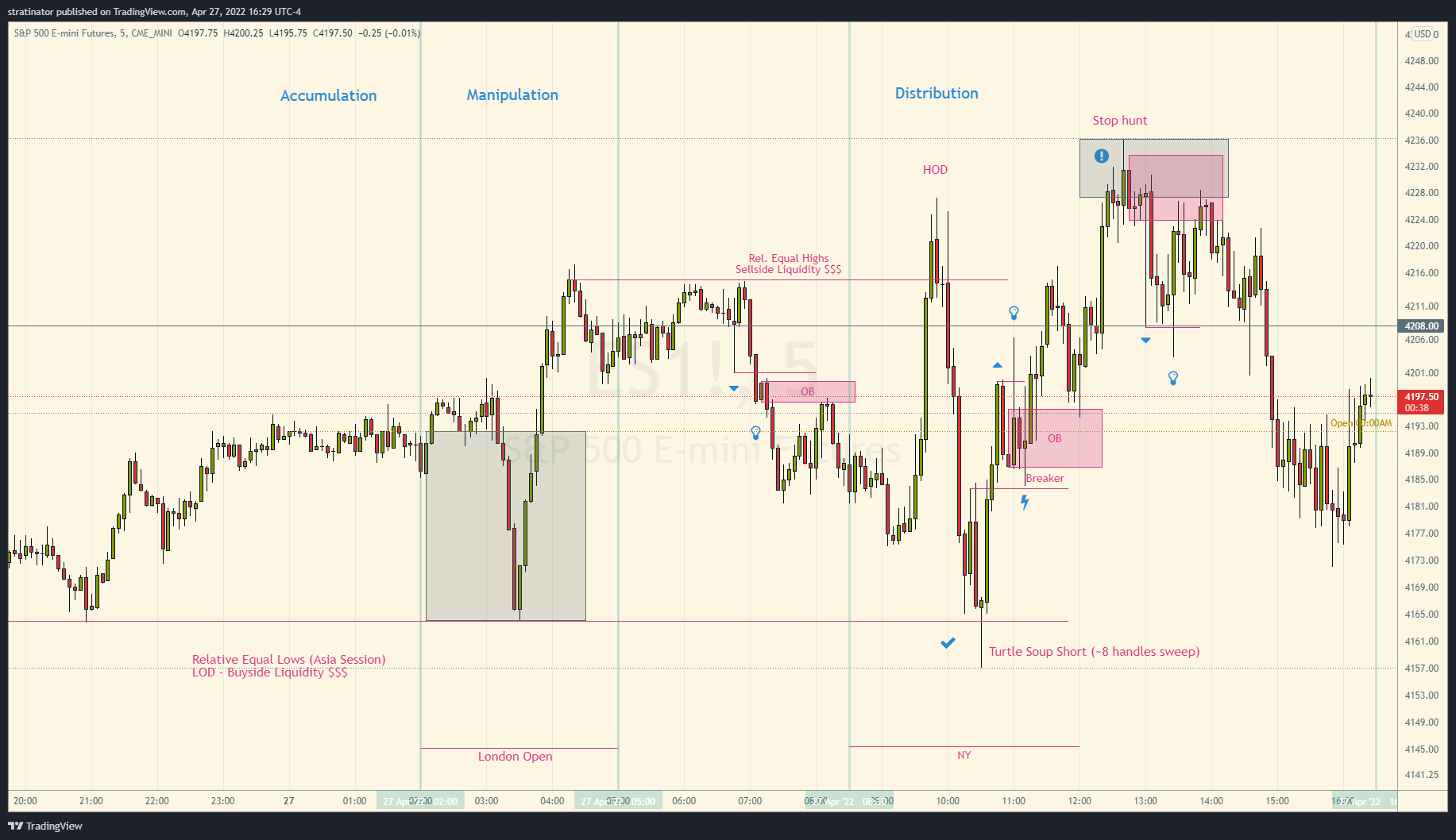

I annotated the $ES_F 5min chart, in hindsight and this is what I came up with.

Thoughts?

$ES 15min, when you have the correct setup marked on the chart since 08:30AM and still don’t trust that we go that low. Tried to long $ES on small pumps and lost. Instead of trusting my setup #ICT

That way, I missed ~100 $ES handles… #Mental issue

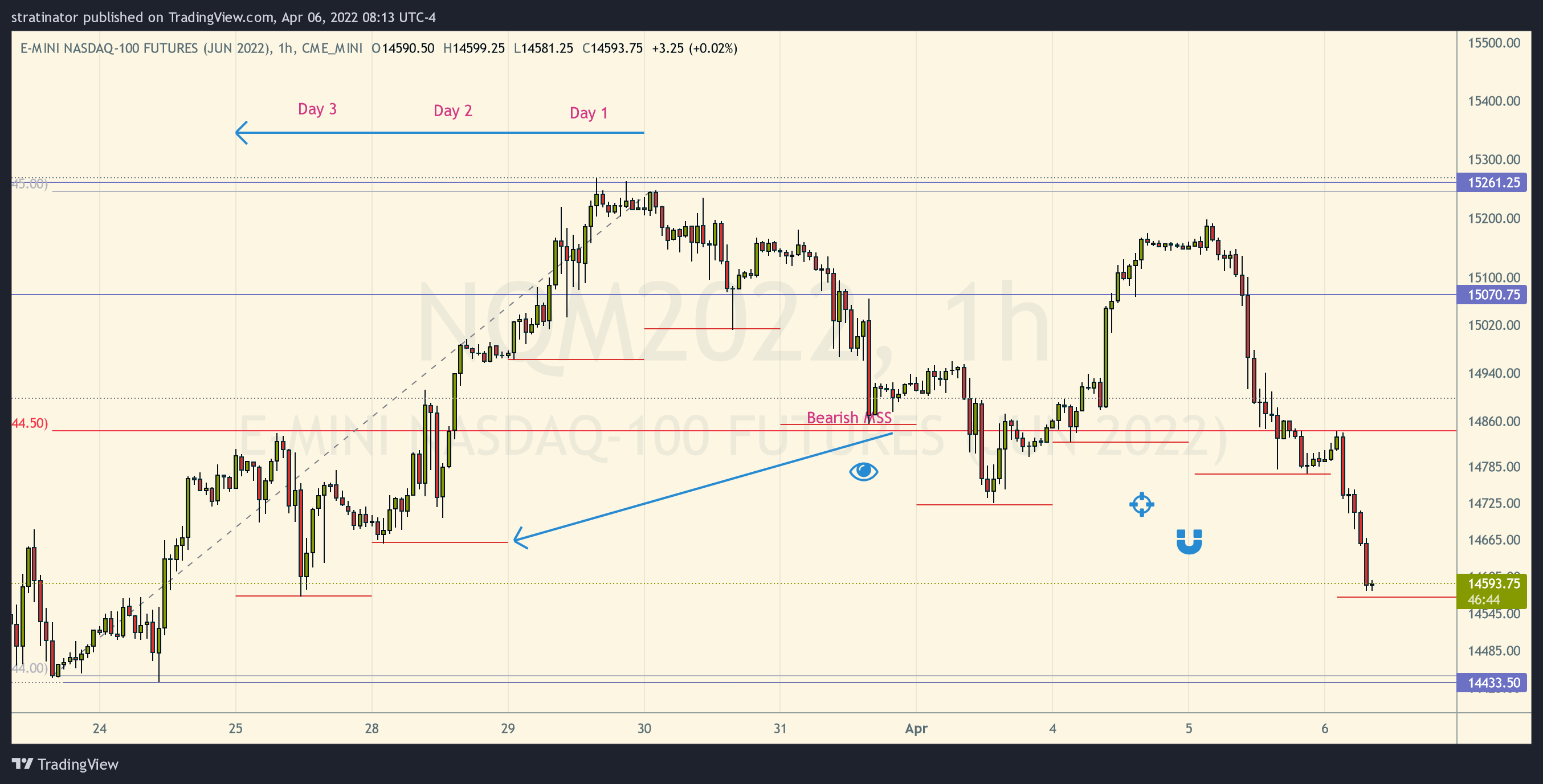

$NQ_F 60min Liquidity Purge&Revert

The annotations on this chart were drawn 3 days ago, just updated the exact lows for each day since then. Seems to work :-) #ICT

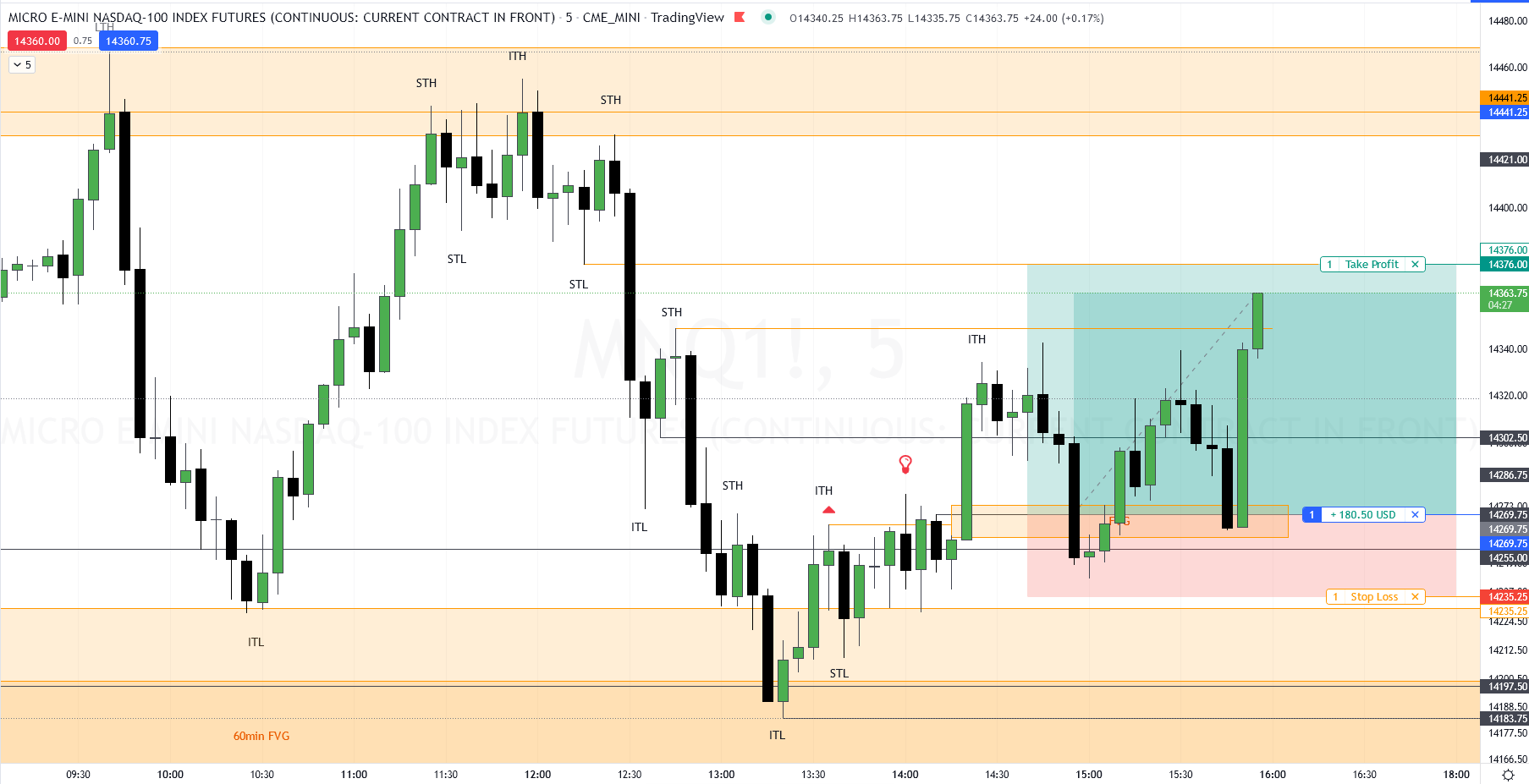

$NQ_F paper trade 2022/4/5 - 1:17 R/R short #ICT

Tuesday, April 5, 2022

Trying to stick to the habit of journaling my papertrades and since today I found a good setup which I planned before ot happened, here is the journal and my thought process. No hindsight this time, as you’ll see on the pictures, they were taken during that trade. But of course, still paper. …$ES_F Backtesting 3/31 price action 1:7 Risk/Reward short #ICT

Friday, April 1, 2022

First, this is drawn all in hindsight after todays close on $ES_F. Those posts help me to learn all that #ICT stuff and getting better at spotting entries right when they happen during trading hours. I get back to theses posts even during the day and find similar setups. I’m nowhere near to …$NQ_F 4min chart, squeezed inside of two orderblocks. I maybe overlooked the lower one today for an entry long. It looks not much, but would have been 50 handles! #ICT

$MNQ_F 3min at high of day, took the short (paper!) because of an imbalance. Tight stops and overnight session is lower volatility, so lets see how this works out. #ICT

$ES_F #ICT Pre-market 1:3 papertrade in 14 minutes :-)

When you spot this all live and it works out, feels so great! :-) @AlexsOptions

Science: 15min -> 5min -> 1min

Still paper, but I’m getting there 🤞 Sticked to the 1:3 R/R and not getting to greedy.

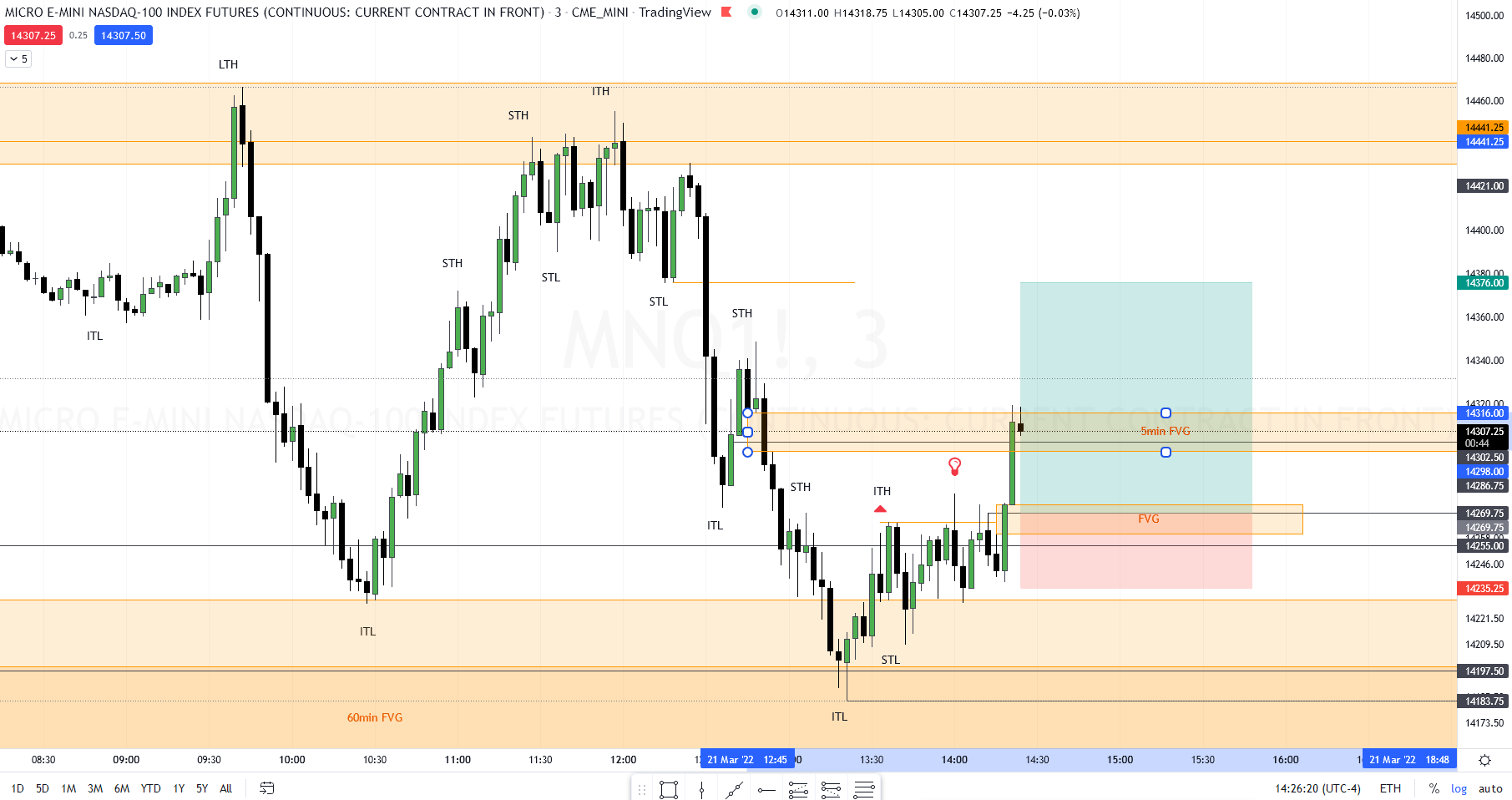

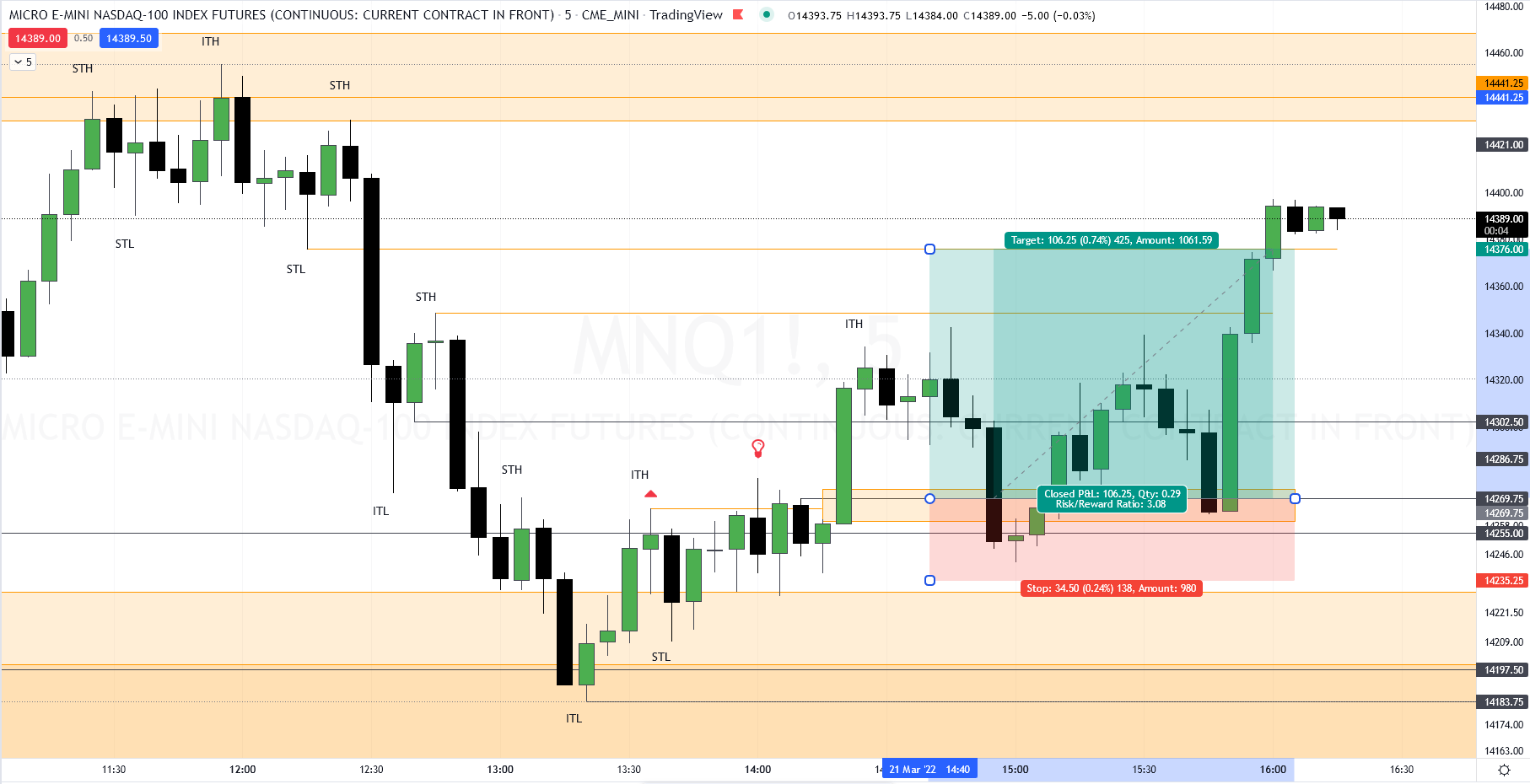

Notes of $MNQ_F 3/22 #ICT for my reference 9.6:1 R/R trade

Thursday, March 24, 2022

I couldn’t figure out yesterday why $NQ and $ES pumped so hard from the open and yesterday and thought it was just “bullish”.

That reason didn’t give me any peace. Here is the science of this setup with a 9.6:1 risk/reward and why it really worked out.

Only papertraded $MNQ_F #ICT-style today, slowly getting it all right.

Last trade was just what I needed for my mindset, hit 14376 right after close :)

3min & 5min annotated chart of my thought process…

Back to the drawing board tonight to get better with the #ICT Mentorship stuff. Got some eye-opening moments yesterday thanks to @AlexsOptions regarding Market Structure shifts. Episode 12 & 13 make much more sense now!

$MES_F 15min #ICT OTE pre-market low->high perfection

$MNQ - a possible outlook into the overnight session, just my novice prediction learning #ICT FVG stuff

Lets see how things really develop, I do not trade this, just watching and learning!

My annotated $ES 1min chart #ICT on todays rally. Sure FOMC was the catalyst, but worked that way.

@AlexsOptions is this MSS what ICT also calls a “Breaker”? Would love to get some feedback on it 🙏

$MNQ – #ICT 3/11 Morning session – annotated chart 5min.

You don’t need to go down to a lower timeframe, 5min also showed it’s hands.

Note: I painted this in hindsight, to train my eyes, I have not traded it, not even in paper.

My charted annotations for $MNQ 3/8 (5min) London morning session into NY session open based on #ICT FVG.

Hope this helps, also feel free to comment if there is something wrong, still learning!! @alexsoptions