Free #SundaySwing ideas week of 1/18 based on #TheStrat

Welcome to a new issue of my #SundaySwing ideas, this time we’re looking into the future with a lot of earnings coming up.

I’ve collected a mixture one short-term weekly swing ideas as well as looking forward to the February expiration.

As written last week, Im in a bit of a conflict because the market really reacted weird after CPI data, volatility and the run up after Thursday’s big drop. And since earnings reports for most of the big names are right around the corner, I try to play it safe and will exit before earnings or select the longer 2/18 expiration to have some time.

Keep in mind that we have a short week with only 4 trading days from Tuesday to Friday!

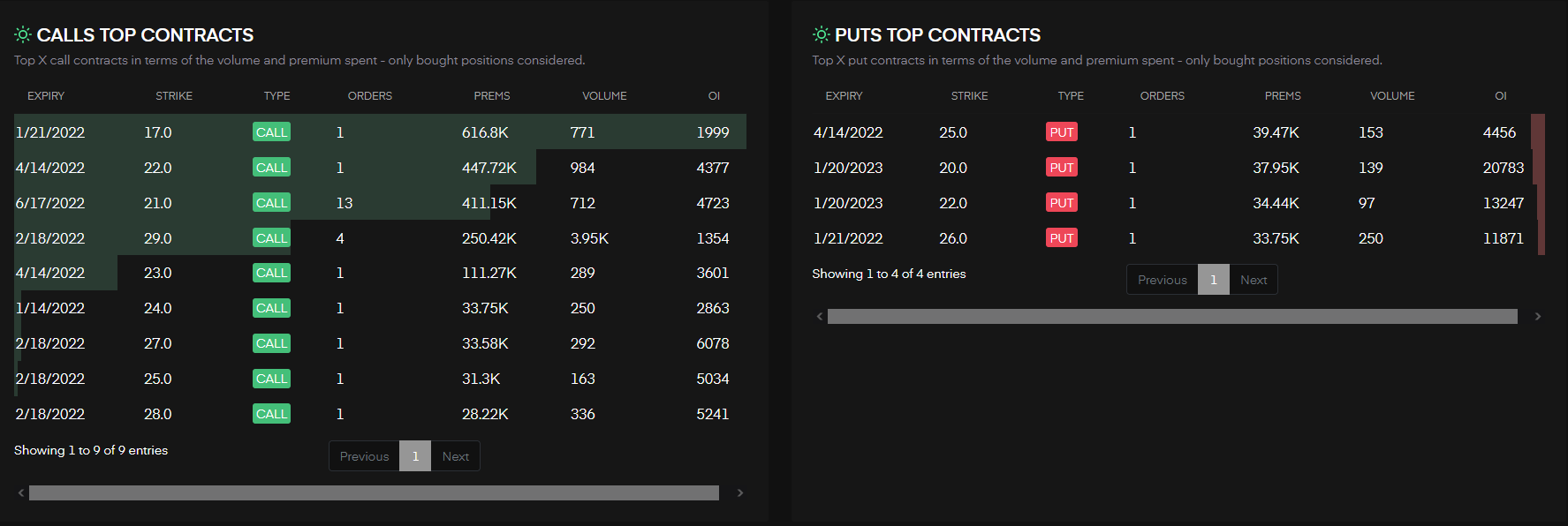

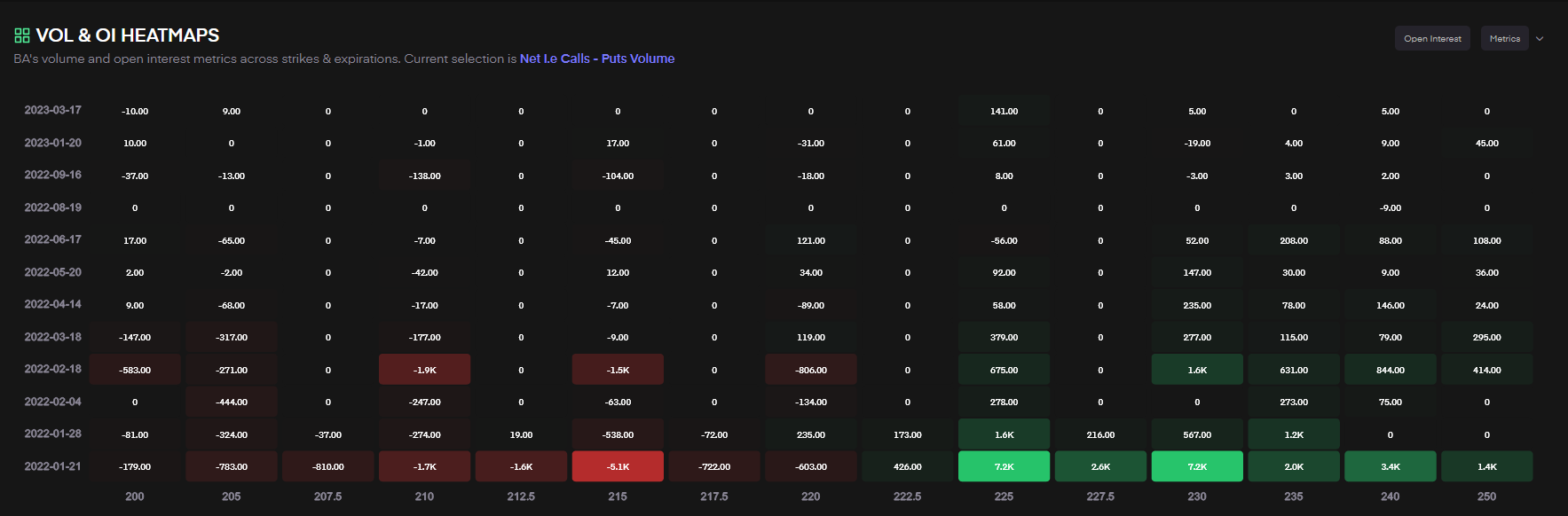

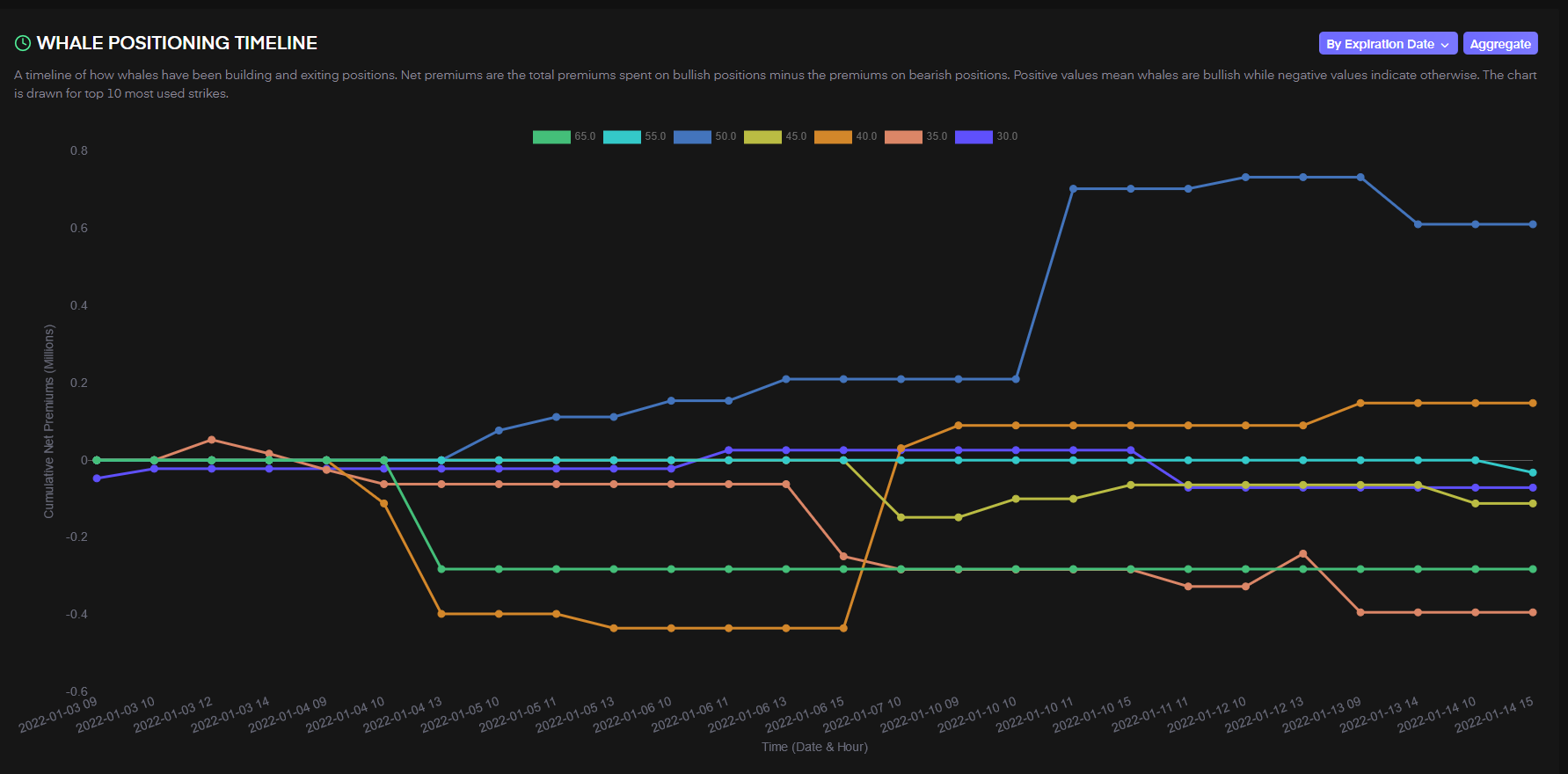

I’m also showing you some extra Tradytics* Data for extra confirmation regarding the flow-site of the ideas.

TLDR;

- $BA 1/28 235c > 226.20

- $FUTU > 2/18 55c > 49.20

- $NIO 2/18 35c > 31.86

- $X 2/18 29c > 26.17

Recap of 1/10 SundaySwing

As expected it was a mixed week. The given triggers were all hit, but it was difficult and I didn’t enter any trade, except $XLE 63c. The reason I didn’t enter the other ones, $QQQ, $IWM and $QCOM was that they dropped below with a gap and this invalidates my trigger.

Disclaimer: No advice, instead these are my ideas based on my knowledge analyzing the charts for possible swing trades based on #TheStrat. So please always do your own due diligence before entering a trade.

Chart setups

Since I got always questions about the colors in my charts and the setups:

- I always chart in multiple time frames Monthly, Weekly, Daily, and 4-hour or 60min

- Purple lines last months high&low

- Orange lines last weeks high&low

- Blueish lines last day high&low

- Green lines are my targets

- Sometimes white and yellow for intermediate targets or 50% rule setups

- The brownish-boxes on the Daily and 4-hour chart you see sometimes show a gap that hasn’t filled yet.

If some of the broadening formation lines looking a bit curved, it is because I switched to logarithmic scale on the charts, but they are still correct.

Outlook

As always lets have a look at $SPY and $QQQ for a rough prediction of what I think the market will do next. Or course it’s just my interpretation, so keep that in mind!

Flow info from Tradytics

Mentioned above, I’m currently testing Tradytics for additional confirmation of my strikes. The link to Tradytics is a referral link, so if you find that service also helpful and want to try it for yourself, I would appreciate it, if you use that link to support me.

$SPY

If you had asked me on Friday 1/14 around lunchtime I would have said the we maybe get an inside week next week. But that run into the close was pretty bullish. However SPY is still 2u and red on the month. If it triggers the daily 465.09 I expect a run up to 470/472 area next week. This would be a nice 3-2-2u possibility with targets at 479 if we get above 473.20.

$QQQ

$QQQ will have to gain some huge points to the upside before I call it bullish, but it was a nice run up last week, after testing and taking out last months lows. So it’s a 2d and red, but will look on the upside around 390 next week. Closed at 380.01 on Friday it’s now 10 points away for a possible 2-2 Reversal on the week to the upside. Since it’s a short week and first major earnings starting week after the next I’m not sure if there is enough time to take out 390.20 going up to the next target 400 area.

Profits and Stops

I usually target around 25-40% of profits on those swings and decide during the market hours if I leave a runner on a position or close the entire one.

Swing ideas

Would love to get some feedback about this format here and if this helps you learn #TheStrat, as well as I’m open for any things that will help more.

$BA 1/28 235c > 226.20

I chose the 1/28 expiration because $BA has earning on 1/26 pre-market, so I likely will exit that position before if it triggered and runs in my direction to avoid the earnings gamble.

Current FTFC up and an inside day on Friday with a Momo hammer setup I look at the 2-1-2 Bullish Continuation above 226.20 and the weekly target of 233.94. If this target is hit by 1/21 I probably swing that into next week, but that depends on the market on Friday.

$FUTU > 2/18 55c > 49.20

$FUTU has currently also FTFC up with an inside month, so this idea is to wait for the 2-2u Month to trigger above 49.20 with the next targets around 57.29 and maybe 64.56. That stock has currently 6 lower highs on the monthly chart and is currently green, so it looks like sellers are out and buyers stepped in again. We might see a reversal on the week, because it’s 2u on both week and daily chart before running up. Earnings are in March, so this is a ER safe-idea as well.

$NIO 2/18 35c > 31.86

Currently in TFC conflict because month is red and still inside, $NIO got my attention because of a possible 2-2 Weekly Reversal above 31.86 and if it hits it’s next magnitude of 33.80 this would 33.80 we have FTFC up. On the daily we might see a nice 1-2-2 Bullish RevStrat above 31.32 with the target of the weekly trigger. But I wait for the weekly 31.86 to trigger before entering that swing.

The Tradytics flow for $NIO doesn’t look what my Strat-Analysis says above, some bullish and some bearish flow, so nothing to show from Tradytics-site here. But of course you can look up Tradytics NIO Options Dashboard for yourself and see for yourself.

$X 2/18 29c > 26.17

FTFC is up, this trade is the only one I would trade through earnings (1/27 post-market) iof it triggers. Outside week last week and currently in a 2-2u in-force monthly with some range to the upside. Also a nice green 2d close on Friday. SO if $X triggeres the week up above 26.17 for a 3-2u Continuation I go in with plenty of time. I chose the 29c because of Tradytics data (see below).