My #SundaySwing ideas for the week of 3/7 based on #TheStrat

This week is a short edition, spent the whole weekend with doing family things. But for my own learning, writing my ideas down for next week, helps me to improve myself to get better.

Again doing only short-term swings this week, because 3/18 expiration is OPEX Friday and due to the high volatility every day can change everything.

As tweeted last week about the $BA short setup, to survive in the current market, you have to adapt quickly and switch to Puts, even if you planned a swing on the long side 2 days before.

The only way for me, is to watch the market daily and skip the swing ideas and not stick to them and lose money.

TLDR;

After last weeks development, more Puts than Calls and we’ll see how this plays out.

- $PEP 3/18 170c > 166.50

- $BYND 3/18 40p < 42.70

- $LCID 3/18 20p < 21.02

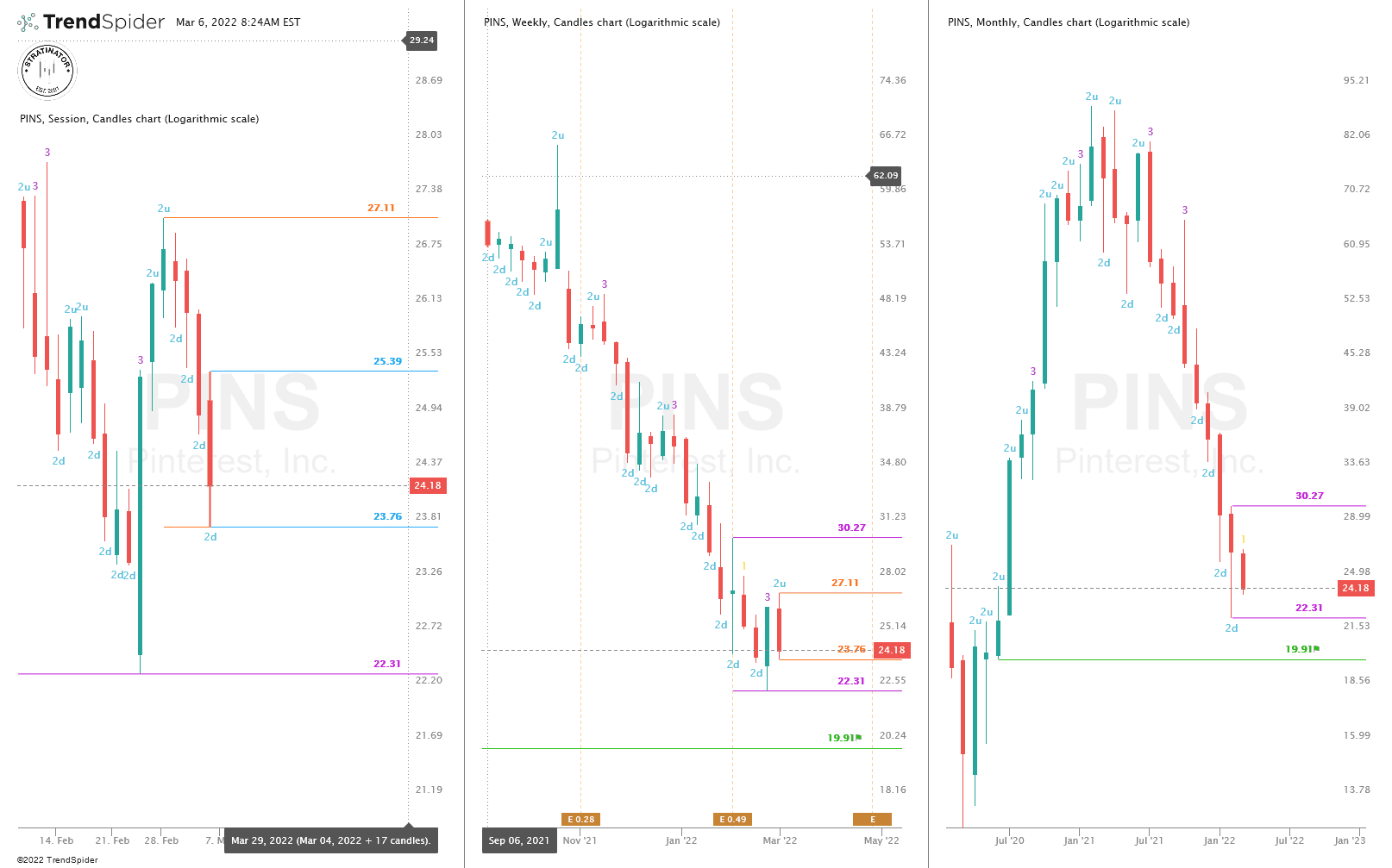

- $PINS 3/18 23p < 23.76

Recap of 2/27 SundaySwing

Quick update, since it wasn’t that great, I was a slightly bullish and I failed with the setups. AAPL triggered but also couldn’t hold the line and broke down on Thursday with the market.

Everything else didn’t even trigger.

But I still keep an eye on $T for the 24.11 trigger next week.

Disclaimer: Not advice, instead these are my ideas based on my knowledge analyzing the charts for possible swing trades based on #TheStrat. So please always do your own due diligence before entering a trade.

Chart setups

Since I got always questions about the colors in my charts and the setups:

- I always chart in multiple time frames Monthly, Weekly, Daily, and 4-hour or 60min

- Purple lines last months high&low

- Orange lines last weeks high&low

- Blueish lines last day high&low

- Green lines are my targets

- Sometimes white and yellow for intermediate targets or 50% rule setups

- The brownish-boxes on the Daily and 4-hour chart you see sometimes show a gap that hasn’t filled yet.

If some of the broadening formation lines looking a bit curved, it is because I switched to logarithmic scale on the charts, but they are still correct.

Outlook

As always lets have a look at $SPY and $QQQ for a rough prediction of what I think the market will do next. Or course it’s just my interpretation, so keep that in mind!

$SPY

Doji candle last week which we closed green, no idea how since it doesn’t felt green. Still staying bearish.

$QQQ

The Q’s look even more bearish to me with that 2u and red weekly candle. Expecting a 2u-2d Bearish Reversal weekly as well. Target would be 318.26 again. So let’s see how this plays out. The 318.26 would also trigger another month 2d.

Profits and Stops

I usually target around 25-40% of profits on those swings and decide during the market hours if I leave a runner on a position or close the entire one.

To view the charts in full detail, click to open them in a new browser window.

$PEP 3/18 170c > 166.50

Only bullish idea this week and closed the week green. Idea is a 2d-1-2u Bullish Reversal Weekly above 166.50. The next target would be 169.12 and 169.67. So the 170c might not go ITM but should be profitable if the idea works out and $PEPs runs to the upside again. FTFC is of course up on Month, Week and Day.

Last Friday 3/4 close as outside day bright green, gives me extra confidence that $PEP might go higher again.

$BYND 3/18 40p < 42.70

Bearish idea No. 1 this week, $BYND. Idea is a 2d-1-2d Bearish Continuation Weekly below 42.70. Still an inside month, 41.33 would trigger another month 2d continuation with no real targets left since $BYND trades already below the IPO price.

So therefore the 40p but also not expect it to go ITM, I simple don’t know what follows below 41.33.

$LCID 3/18 20p < 21.02

Next bearish idea, since market is bearish as you should have realized by now :-)

$LCID with the 2u-2d Bearish Reversal Weekly below 22.01. The monthly trigger for another 2d is 21.77. Below this it could get really ugly for $LCID. Looking back the weekly charts in September 2021 where 18.70 is my next target.

$PINS 3/18 23p < 23.76

No bullish reversal insight on $PINS. Idea is the 3-2u-2d Bearish Reversal Weekly below 23.76. Target is the low of the outside week 22.31 which also triggers another 2d month. If market really stays bearish also 19.91 could be possible, but keep in mind that for the 3/18 expiration only 2 weeks are left.

With that — thanks for reading!

Have a nice green successful week!